ERTC

...is a government initiative aimed at providing financial relief to businesses during challenging times.This credit is designed to encourage employers to retain their employees rather than resort to layoffs or furloughs. By offering eligible businesses a tax credit based on a percentage of qualified wages paid to employees, the ERTC serves as an incentive to maintain a stable workforce. This credit has proven especially valuable during economic disruptions, helping businesses sustain operations while also supporting the livelihoods of their employees. The specific eligibility criteria and calculations can vary based on the current regulations and guidelines set by the tax authorities. It's essential for businesses to stay informed about the latest updates to make the most of this beneficial program.

how the

ERTC Works

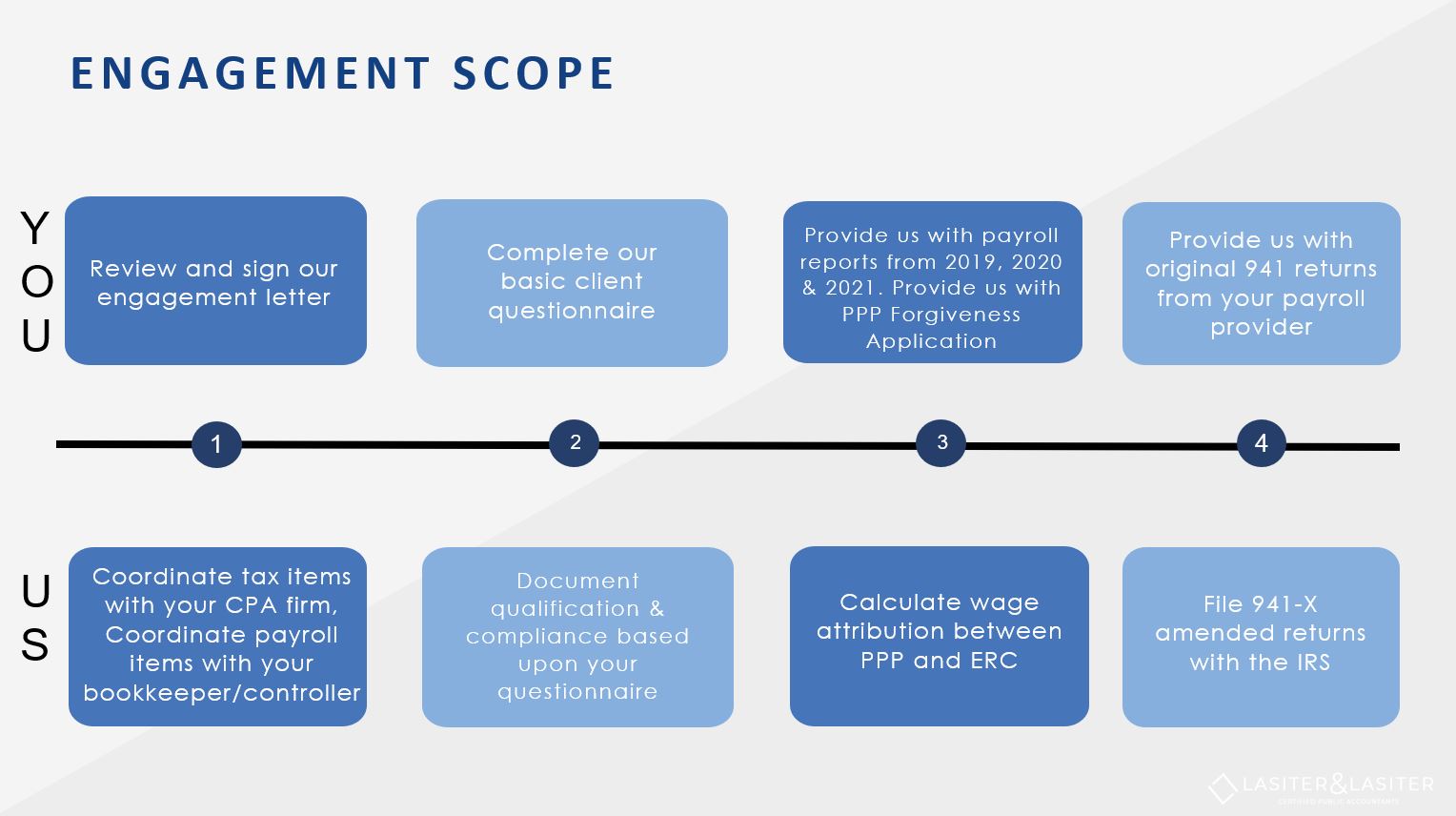

Watch this presentation to understand more about the qualification process, scope and support offered from our firm. We can walk you through the process and answer any questions you may have about how this might affect your business. Contact us for any questions or to sign up for this tax credit.

GUARANTEES & AUDIT SUPPORT

- We DO NOT guarantee any specific refund amount until we have payroll data

- We DO guarantee that our calculations are accurate

- We DO guarantee that our filings with the IRS as a paid-preparer are compliant with program rules and regulations

- We are a 3rd generation CPA firm, with a long history. We have served our clients for over 50 years and will provide long-term audit support.

- We carry E&O (errors & omissions) insurance coverage with up to $1 Million per event